Are Salaries Considered Fixed Costs . That’s because it doesn’t change as the production or sales. if you pay an employee a constant salary, they're a fixed payroll cost. fixed costs are expenses that don’t change, no matter how much a business produces or earns. They can be be used when calculating. for example, a software development company has a fixed cost requirement of $500,000 per month and. a fixed cost is a business expense that does not vary even if the level of production or sales changes. Employees who work an hourly wage are a. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked marketing and. In most cases, salary is a fixed cost. in accounting, costs are considered fixed or variable, with all businesses using a combination of both. Is salary a fixed or variable cost? Examples include rent, insurance, and employee.

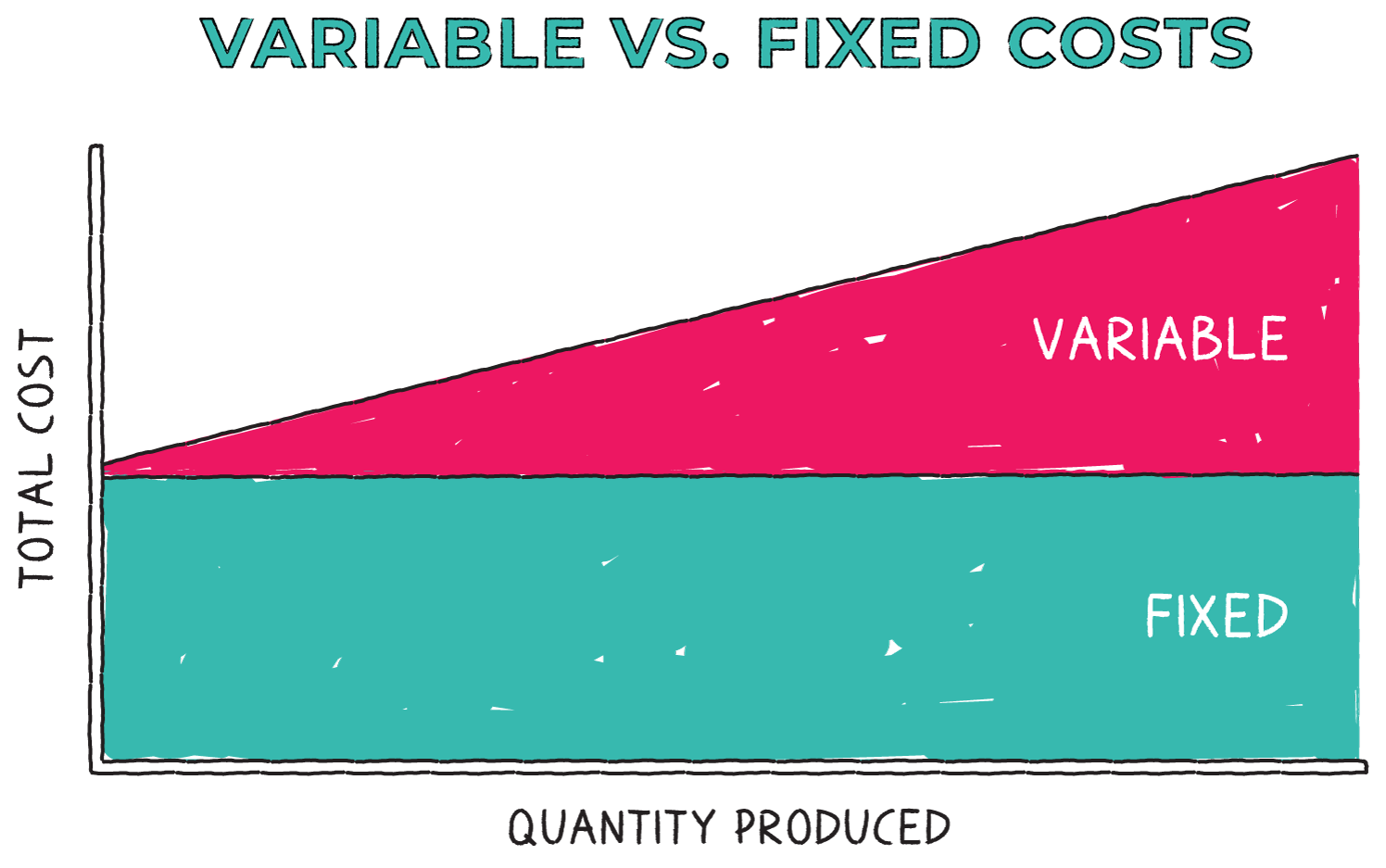

from napkinfinance.com

for example, a software development company has a fixed cost requirement of $500,000 per month and. Examples include rent, insurance, and employee. Employees who work an hourly wage are a. in accounting, costs are considered fixed or variable, with all businesses using a combination of both. They can be be used when calculating. a fixed cost is a business expense that does not vary even if the level of production or sales changes. In most cases, salary is a fixed cost. Is salary a fixed or variable cost? some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked marketing and. That’s because it doesn’t change as the production or sales.

What is Fixed Cost vs. Variable Cost? Napkin Finance

Are Salaries Considered Fixed Costs They can be be used when calculating. a fixed cost is a business expense that does not vary even if the level of production or sales changes. fixed costs are expenses that don’t change, no matter how much a business produces or earns. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked marketing and. if you pay an employee a constant salary, they're a fixed payroll cost. That’s because it doesn’t change as the production or sales. Examples include rent, insurance, and employee. Is salary a fixed or variable cost? They can be be used when calculating. in accounting, costs are considered fixed or variable, with all businesses using a combination of both. Employees who work an hourly wage are a. for example, a software development company has a fixed cost requirement of $500,000 per month and. In most cases, salary is a fixed cost.

From www.paisabazaar.com

Salary Structure, Components, How to Calculate TakeHome Salary Are Salaries Considered Fixed Costs fixed costs are expenses that don’t change, no matter how much a business produces or earns. Is salary a fixed or variable cost? In most cases, salary is a fixed cost. Employees who work an hourly wage are a. Examples include rent, insurance, and employee. some typical classes of avoidable costs include direct materials, direct labor, variable overheads,. Are Salaries Considered Fixed Costs.

From riable.com

Fixed Costs Riable Are Salaries Considered Fixed Costs Employees who work an hourly wage are a. They can be be used when calculating. In most cases, salary is a fixed cost. fixed costs are expenses that don’t change, no matter how much a business produces or earns. if you pay an employee a constant salary, they're a fixed payroll cost. in accounting, costs are considered. Are Salaries Considered Fixed Costs.

From www.educba.com

Fixed Cost Vs Variable Cost Top 12 Key Differences & Examples Are Salaries Considered Fixed Costs They can be be used when calculating. for example, a software development company has a fixed cost requirement of $500,000 per month and. Employees who work an hourly wage are a. fixed costs are expenses that don’t change, no matter how much a business produces or earns. Examples include rent, insurance, and employee. some typical classes of. Are Salaries Considered Fixed Costs.

From definitionjull.blogspot.com

Fixed Cost Definition Economics definitionjull Are Salaries Considered Fixed Costs fixed costs are expenses that don’t change, no matter how much a business produces or earns. They can be be used when calculating. Is salary a fixed or variable cost? if you pay an employee a constant salary, they're a fixed payroll cost. Examples include rent, insurance, and employee. for example, a software development company has a. Are Salaries Considered Fixed Costs.

From www.akounto.com

Fixed vs. Variable Cost Differences & Examples Akounto Are Salaries Considered Fixed Costs In most cases, salary is a fixed cost. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked marketing and. They can be be used when calculating. That’s because it doesn’t change as the production or sales. Employees who work an hourly wage are a. fixed costs are expenses that don’t change, no. Are Salaries Considered Fixed Costs.

From www.patriotsoftware.com

What Are Fixed Costs in Business? Unchanging Business Expenses Are Salaries Considered Fixed Costs for example, a software development company has a fixed cost requirement of $500,000 per month and. Is salary a fixed or variable cost? They can be be used when calculating. fixed costs are expenses that don’t change, no matter how much a business produces or earns. Examples include rent, insurance, and employee. some typical classes of avoidable. Are Salaries Considered Fixed Costs.

From vertigowallpaper.blogspot.com

Is Most Likely To Be A Fixed Cost / But when your overhead is lower Are Salaries Considered Fixed Costs Employees who work an hourly wage are a. fixed costs are expenses that don’t change, no matter how much a business produces or earns. In most cases, salary is a fixed cost. a fixed cost is a business expense that does not vary even if the level of production or sales changes. for example, a software development. Are Salaries Considered Fixed Costs.

From www.levels.fyi

SIB Fixed Cost Reduction Salaries Levels.fyi Are Salaries Considered Fixed Costs in accounting, costs are considered fixed or variable, with all businesses using a combination of both. In most cases, salary is a fixed cost. That’s because it doesn’t change as the production or sales. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked marketing and. They can be be used when calculating.. Are Salaries Considered Fixed Costs.

From wealthnation.io

How to Balance Fixed Expenses with Variable Costs Wealth Nation Are Salaries Considered Fixed Costs They can be be used when calculating. fixed costs are expenses that don’t change, no matter how much a business produces or earns. a fixed cost is a business expense that does not vary even if the level of production or sales changes. for example, a software development company has a fixed cost requirement of $500,000 per. Are Salaries Considered Fixed Costs.

From www.simple-accounting.org

Are Salaries Fixed or Variable Costs? Are Salaries Considered Fixed Costs They can be be used when calculating. if you pay an employee a constant salary, they're a fixed payroll cost. Examples include rent, insurance, and employee. Employees who work an hourly wage are a. That’s because it doesn’t change as the production or sales. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly. Are Salaries Considered Fixed Costs.

From jupiter.money

What is Fixed Salary? Jupiter Money Are Salaries Considered Fixed Costs for example, a software development company has a fixed cost requirement of $500,000 per month and. fixed costs are expenses that don’t change, no matter how much a business produces or earns. in accounting, costs are considered fixed or variable, with all businesses using a combination of both. Is salary a fixed or variable cost? In most. Are Salaries Considered Fixed Costs.

From www.chegg.com

Solved Total Fixed Costs Rent Office salaries Equipment Are Salaries Considered Fixed Costs Is salary a fixed or variable cost? in accounting, costs are considered fixed or variable, with all businesses using a combination of both. They can be be used when calculating. fixed costs are expenses that don’t change, no matter how much a business produces or earns. Examples include rent, insurance, and employee. for example, a software development. Are Salaries Considered Fixed Costs.

From www.slideteam.net

Spend Analysis Salaries And Wages Fixed And Variable Costs PowerPoint Are Salaries Considered Fixed Costs Is salary a fixed or variable cost? Examples include rent, insurance, and employee. fixed costs are expenses that don’t change, no matter how much a business produces or earns. in accounting, costs are considered fixed or variable, with all businesses using a combination of both. if you pay an employee a constant salary, they're a fixed payroll. Are Salaries Considered Fixed Costs.

From www.bizplan.com

Startup Fixed Costs Are Salaries Considered Fixed Costs a fixed cost is a business expense that does not vary even if the level of production or sales changes. fixed costs are expenses that don’t change, no matter how much a business produces or earns. In most cases, salary is a fixed cost. Employees who work an hourly wage are a. Examples include rent, insurance, and employee.. Are Salaries Considered Fixed Costs.

From napkinfinance.com

What is Fixed Cost vs. Variable Cost? Napkin Finance Are Salaries Considered Fixed Costs They can be be used when calculating. Employees who work an hourly wage are a. In most cases, salary is a fixed cost. That’s because it doesn’t change as the production or sales. for example, a software development company has a fixed cost requirement of $500,000 per month and. some typical classes of avoidable costs include direct materials,. Are Salaries Considered Fixed Costs.

From fi.money

Difference Between Fixed And Variable Salary Fi Money Are Salaries Considered Fixed Costs in accounting, costs are considered fixed or variable, with all businesses using a combination of both. In most cases, salary is a fixed cost. Examples include rent, insurance, and employee. That’s because it doesn’t change as the production or sales. fixed costs are expenses that don’t change, no matter how much a business produces or earns. Is salary. Are Salaries Considered Fixed Costs.

From www.planprojections.com

Cost Behavior Analysis in Financial Projections Plan Projections Are Salaries Considered Fixed Costs a fixed cost is a business expense that does not vary even if the level of production or sales changes. In most cases, salary is a fixed cost. in accounting, costs are considered fixed or variable, with all businesses using a combination of both. if you pay an employee a constant salary, they're a fixed payroll cost.. Are Salaries Considered Fixed Costs.

From www.1099cafe.com

What is a Fixed Cost Variable vs Fixed Expenses — 1099 Cafe Are Salaries Considered Fixed Costs They can be be used when calculating. if you pay an employee a constant salary, they're a fixed payroll cost. Examples include rent, insurance, and employee. for example, a software development company has a fixed cost requirement of $500,000 per month and. in accounting, costs are considered fixed or variable, with all businesses using a combination of. Are Salaries Considered Fixed Costs.